RESMED (RMD)·Q2 2026 Earnings Summary

ResMed Beats on Revenue and EPS as Gross Margin Expansion Continues

January 29, 2026 · by Fintool AI Agent

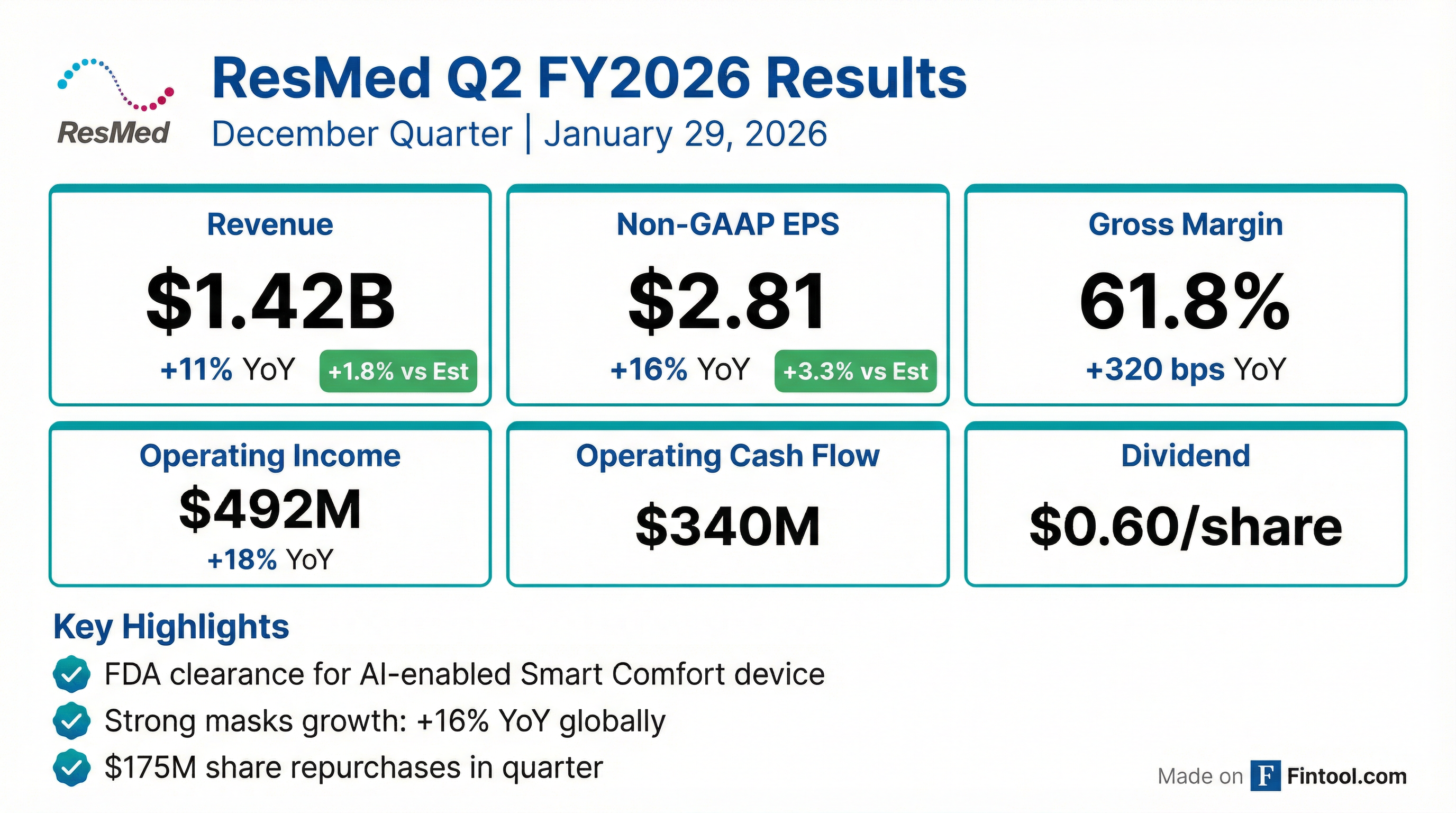

ResMed delivered a solid Q2 FY2026 with revenue of $1.42B (+11% YoY) and non-GAAP EPS of $2.81 (+16% YoY), beating consensus on both metrics. The standout was continued gross margin expansion—up 310 basis points YoY to 62.3%—driven by manufacturing efficiencies that have now delivered margin improvement for five consecutive quarters. Management raised FY2026 gross margin guidance to 62-63%.

Did ResMed Beat Earnings?

Yes, on both revenue and EPS.

*Values retrieved from S&P Global

The GAAP EPS miss reflects $6M in restructuring charges related to workforce planning activities completed in Q1. Excluding these one-time costs, operating performance exceeded expectations.

Revenue Trend (Last 8 Quarters)

What Drove the Beat?

Masks Growth Outpacing Devices

The masks and accessories segment was the clear outperformer, growing 16% YoY globally versus 9% for devices. This higher-margin resupply business now represents 42% of Sleep and Breathing Health revenue.

Margin Expansion Engine Firing

Gross margin of 62.3% represents a 310 bps improvement YoY and 30 bps sequential improvement, continuing a multi-quarter trend:

FY2026 Guidance: 62-63% gross margin (raised from prior expectations).

Management attributed the improvement to component cost reductions and manufacturing/logistics efficiencies. CEO has challenged the supply chain team to deliver double-digit basis points improvement every year through 2030.

Geographic Performance

Americas continues to lead growth, with the U.S., Canada, and Latin America delivering 11% growth versus 6% constant currency for rest of world:

What Changed From Last Quarter?

Three key developments:

-

FDA Clearance for AI-Enabled Device: ResMed launched "Comfort Match," the company's first FDA-cleared AI-enabled medical device. It's an AI comfort setting recommender within the myAir platform that helps patients personalize CPAP settings and improve adherence.

-

New Fabric Masks Launched: F30i Comfort and F30i Clear—the first compact full-face fabric masks from ResMed—launched in select markets with "incredibly positive" patient and provider feedback.

-

Brain Health Research Published: JAMA Neurology study (11M+ U.S. veterans) found OSA associated with higher incidence of Parkinson's disease, with early CPAP treatment potentially reducing risk. Growing evidence shows untreated moderate-to-severe OSA increases dementia likelihood by 30-45%.

-

CME Education Scaled Up: 60,000 training completions (50% increase QoQ), 35,000+ unique clinicians trained, 77% intend to change clinical practices on sleep apnea screening and referral.

-

Indiana Distribution Center: Lease signed and construction started; on track for calendar 2027. Will enable 90% of U.S. customers to receive shipments in <2 business days.

-

Restructuring Complete: $6M in restructuring charges finalized the workforce planning activities announced in Q1.

Capital Allocation

ResMed continues aggressive shareholder returns while maintaining investment capacity:

CEO announced increased buyback commitment: ResMed will repurchase more than $600M in shares for FY2026, up from prior plans. The board declared a quarterly dividend of $0.60/share.

The GLP-1 Question

The key investor debate around ResMed remains whether GLP-1 weight loss drugs will cannibalize sleep apnea device demand. Management has consistently argued the opposite—that GLP-1s are actually driving demand for CPAP therapy.

Updated claims data (1.95 million patients tracked):

"What we're finding is patients on a GLP-1 get on CPAP more and stay on CPAP therapy longer... It's encouraging to see that the motivation of these patients lasts and even accelerates over time." — Mick Farrell, CEO

The 3-year data is new this quarter and shows the GLP-1 tailwind accelerating over time rather than fading. Even if patients discontinue GLP-1s (where adherence is often only 30-40% at 1 year), they appear to stay motivated on CPAP therapy.

Q&A Highlights

On U.S. Masks Growth (16% YoY):

"Even without Virtuox, still double-digit growth, so still really strong... Some seasonality impact from high-deductible health plans clearing at quarter-end, but also early days for the new fabric mask launches—off to a good start." — Brett Sandercock, CFO

On Philips Re-Entry to U.S.:

"They're back in over 100 countries in Europe, Asia, rest of the world... and I don't know if you looked into the Europe, Asia, rest of the world device growth in the quarter, pretty solid. They're at 5%, right in line with market... We're holding share and competing well." — Mick Farrell, CEO

On SG&A Growth (15% headline):

"There was some impact from the Virtuox acquisition. If you excluded that, we would be at high single digits for SG&A growth. So tracking pretty close on revenue growth." — Brett Sandercock, CFO

On PCP Channel ROI:

"60,000 trainings we've done on CME with PCPs... it was the number one downloaded PCP training in the last quarter, and it was up 50% just in the quarter." — Mick Farrell, CEO

How Did the Stock React?

The stock closed at $257.67, essentially flat on the day, as results were released after market close. After-hours trading showed minimal movement (~$257.61).

The muted reaction likely reflects that the beat was in-line with the improving trend investors expected, with no major positive or negative surprises on guidance (ResMed does not provide formal quarterly guidance).

What to Watch Next

- GLP-1 Demand Dynamics: The 3-year data showing 6%+ higher resupply suggests tailwind is accelerating—watch for continued claims data updates

- Gross Margin Runway: New guidance of 62-63% for FY26; CEO has challenged supply chain to deliver double-digit bps improvement annually through 2030

- U.S. Manufacturing Expansion: Indiana distribution center (CY2027) + Calabasas plant doubling capacity = "only made-in-America CPAP" positioning

- Comfort Match Adoption: Impact of first FDA-cleared AI device on adherence metrics and patient engagement through myAir (11M users)

- Philips U.S. Re-Entry: Timing still unknown, but ResMed has been competing well in 100+ international markets where Philips already returned

ResMed's Q2 FY2026 earnings call webcast is available at 1:30 p.m. PT / 4:30 p.m. ET on January 29, 2026 at investor.resmed.com.

View Full Company Profile | View Q1 FY2026 Earnings | Read Q2 FY2026 Transcript